Despite the fact that conditions are enhancing as we are rising up out of one of the most exceedingly terrible subsidence ever, getting business financing stays hard. This is troublesome for little organizations since they are having the hardest time getting financing despite the fact that they require it the most. Outsourced work organizations, for example, security monitor organizations and staffing offices are seeing a huge change in their deals however can’t complete on the grounds that they are not very much financed.

To make things difficult, business clients that used to pay their invoices in 30 days are presently taking 45 days or longer to pay. This makes a genuine income issue, since security watch organizations need to cover finance on a week by week premise. Hardly any organizations can bear to hold up that long to get paid.

One approach to take care of this income issue is to abbreviate the time between conveyance of administrations and receipt of installment. Since requesting that customers pay sooner from time to time works, the option is to utilize invoice factoring.

Invoice factoring company gives a progress on moderate paying invoices. The mechanics are straightforward. You pitch the invoice to a factoring company, who pays you for it forthright. This furnishes you with the assets you have to meet your company’s costs. The exchange is settled once your customer forks over the required funds. Factoring organizations dependably structure the buy in two sections. The initial segment, called the propel, covers 80% to 90% of the invoice and is given to you instantly. The second part, which is the staying 10% to 20% is given once your customer pays. The factoring charge is generally deducted from the second exchange.

Invoice factoring has been picking up notoriety in the previous couple of years. What’s more, by and large, invoice factoring can give a superior arrangement than a business advance. Moreover, factoring is less demanding to get than most business credits.

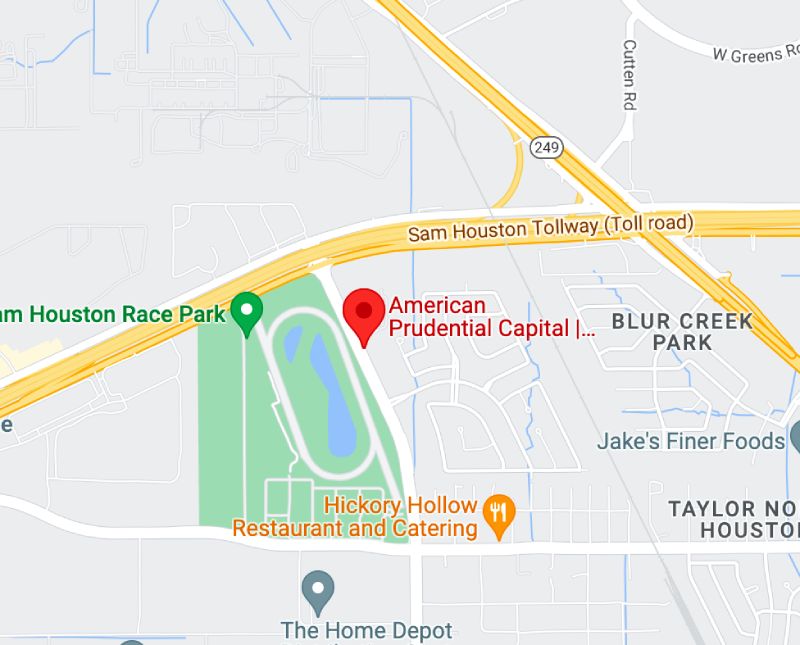

A noteworthy favorable position of factoring is that factoring organizations take a gander at the credit nature of your invoices as a standout amongst the most essential parameters in their subsidizing choices. This implies little yet well run organizations whose lone resource are invoices from great customers can generally qualify. American Prudential Capital is one of the best factoring companies.

Other articles:

https://www.americanprudentialcapital.com/news/the-worth-of-invoice-factoring-companies/

https://www.americanprudentialcapital.com/news/understanding-invoice-factoring/

https://www.americanprudentialcapital.com/news/unusual-funding-options-for-middle-sized-business/

https://www.americanprudentialcapital.com/news/utilizing-an-invoice-factoring-company/

https://www.americanprudentialcapital.com/news/ways-to-get-working-capital-with-invoice-funding-and-financing/

https://www.americanprudentialcapital.com/news/ways-to-select-the-very-best-factoring-finance-business-for-your-service/

Production companies tend to be cash flow extensive companies. They are continuously paying providers and workers. There are equipment, payroll, supplier and leasing expenses to deal with. Most managers (or owners) will do their best to keep up to this day with these payments, or they run the risk of getting their business into difficulty. What usually gets cash flow into problem is that many customers pay their invoices in 30 to 60 days. Generally, the majority of owners need to pay suppliers before they earn money by customers. For that reason, unless the company has a cash reserve, it will face issues.

Production companies tend to be cash flow extensive companies. They are continuously paying providers and workers. There are equipment, payroll, supplier and leasing expenses to deal with. Most managers (or owners) will do their best to keep up to this day with these payments, or they run the risk of getting their business into difficulty. What usually gets cash flow into problem is that many customers pay their invoices in 30 to 60 days. Generally, the majority of owners need to pay suppliers before they earn money by customers. For that reason, unless the company has a cash reserve, it will face issues.