Among the adverse effects of the recession is that more companies need company financing while less institutions wanted to provide it. Because of this, business began trying to find other alternatives to company loans. One of the choices that has acquired significant traction in the last year is invoice factoring.

Invoice factoring is a kind of funding that is often used by invoice factoring company. It’s preferably fit for companies that are offering goods/services on net 30 to net 60 days, but can’t afford to wait for payment. This is a common problem because most medium sized companies have instant expenses and don’t have the required capital to wait on payment.

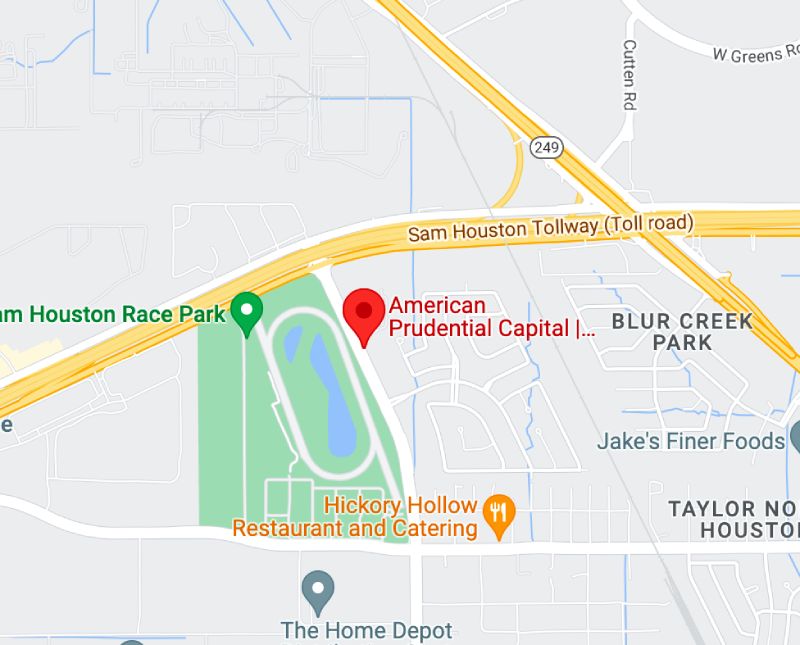

Best Factoring Companies solve this issue by speeding up payment of your billings. They act as an intermediary who purchases your billings and pays you for them immediately. This provides your company with the essential cash flow to pay operating costs and handle brand-new orders. The factoring company, which now holds the invoice, waits on your customer to pay for the billing and settle the deal. American Prudential Capital is amongst the best factoring company in Houston.

An aspect usually buys your invoice in two payments. The very first payment, called the advance, is generally 80% of the billing. The remaining 20% is called the reserve and is held to cover any billing inconsistencies and prospective underpayments. As soon as your customer pays the invoice completely, the factoring business sends the 2nd payment, which is the 20% reserve less the factoring charge.

Factoring charges are identified by the credit quality of your customers, the volume of financing that you need, your industry and billing diversity. They differ in variety however they are typically a particular percentage of the acquired invoices.

One of the huge benefits of invoice factoring is that factoring business consider the credit quality of your billings to be your greatest property. This suggests that medium-sized companies that have a solid roster of clients can usually certify.