Being in the distribution business is all about meeting time restraints. You have to get the products to your customers at a certain place and by a certain time. This means you need fast reaction times, an adequate and reliable fleet of vehicles, and the systems and staff to ensure that the goods are where they should be at the time you said they would arrive.

With all this in mind, it is hardly surprising that not having adequate cash flow can cause major problems for small distribution companies.

Perhaps one of your vehicles is off the road and you do not have the spare cash to get it fixed and running again? Maybe one of your main customers has requested increased deliveries but you do not have the capacity to cope with it?

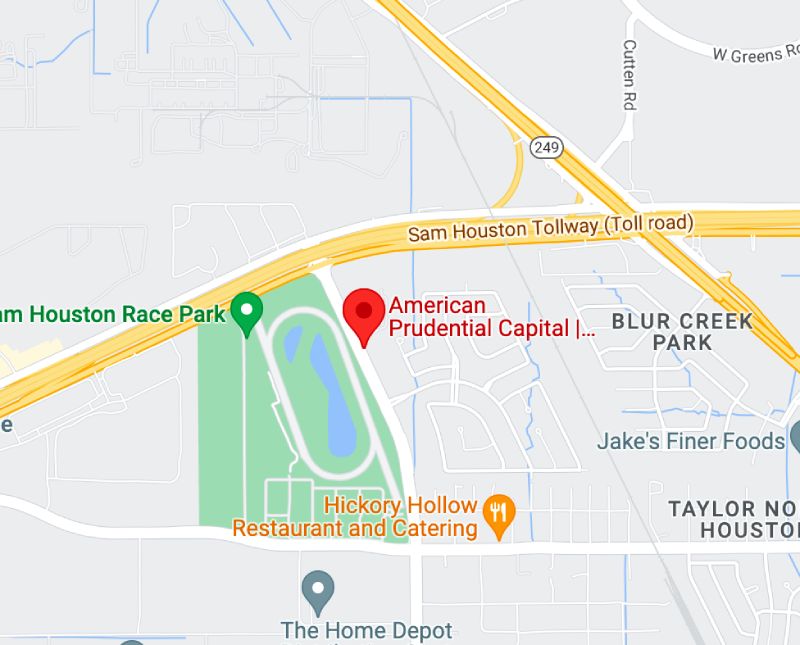

Whatever your problems, if a short-term injection of cash could help, then American Prudential Capital would like to hear from you. Our alternative funding is an excellent fit for this kind of flexibility requirement.

As one of the top-ranked specialty financing companies, we offer alternative funding so that you can buy that extra truck or take on extra staff, thus helping you to fulfill your contracts and even grow your company.

Let us take a look at the ways in which we can give you distribution company funding and the cash you so vitally need to keep your show on the road.

The Simplest Option—Invoice Factoring

One of the easiest ways to release some of your potential income is to sell off your invoices to a company such as ours. Known as invoice factoring, it simply involves trading off or selling your future receivables in exchange for immediate cash.

If you have got thousands of dollars tied up in invoices that have already been issued but not yet paid, then we can buy these invoices from you. Rather than having to wait between 30 and 90 days for payment, and suffer the problems of inadequate cash flow, we will give you the money to buy that new truck or invest in a new system, or pay off your own suppliers.

Looking for the Best Invoice factoring Company is a fuss-free solution to cash flow problems. You simply choose how many of your invoices you would like to factor, whether it is just enough to cover your temporary cash flow problems, or you want to factor all your invoices. We will then buy your invoices or accounts receivable from you at a price that reflects a percentage of the cost stated on the original invoice.

How will invoice factoring benefit your distribution company?

- You will get the money you need very quickly, usually within 24 hours of your application being approved.

- You can choose to sell all of your accounts receivable, or just a selection of them, depending on how much cash you need.

- Once you have sold your invoices, we will take the responsibility of collecting that money, leaving you to concentrate on YOUR business.

- There is no need to take on extra staff to look after invoice billing or chase bad debt.

- Invoice factoring releases funds much more quickly than traditional methods of funding.

- You do not need to have an excellent credit rating. We take into account the credit rating of your customers, as they are the people that are going to pay us.

Find Out More About Distribution Company Funding

Knowing that you have quick and easy access to the funds you need for your distribution business can be such a huge weight on your mind. At American Prudential Capital, we believe that small businesses are the backbone of our country and we want to help you thrive.