Unique Small Business Startup Funding Options

Ask any Houston area startup or small business how difficult it is to get momentum, and they will say getting traction is like sneakers in wet grass: slippery. The uncertainty of erratic working capital can be extremely stressful for small businesses in Houston, especially young startup businesses in search of financing. When a new business needs help, startup funding is an option.

Many startups lack the funds, credit history, and collateral to qualify for traditional bank loans or small business funding. This lack of funds makes it difficult for small business owners to succeed. As an invoice funding company with a stellar reputation, American Prudential Capital (APC) may be able to help you get your startup funding.

Federal grants are great but are often only available for a limited group, such as women in need of money for small business startups. A business loan is one of the traditional ways a company may start, but like federal grants, obtaining a loan may not be feasible. That is why APC is here, dedicated to helping start unique business funding outside of grant money. This funding allows everyone, including women, to have access to start their business operations. APC understands that the American small business makes up the backbone of our country.

Many startups fail because of an inability to obtain startup funding for cash flow to launch their business dynamically and forcefully. This is why APC does everything possible to keep an American small business a success. Bank loans have been the traditional method of funding option for American entrepreneurs who wish to start a small business.

There are funding options other than grants or loans that help any business with an invoicing system to enjoy a strong start. APC is here to help, offering a variety of startup funding services to support new businesses to achieve their goals and give them a solid start.

Complete Startup Funding Services

Whether a business is a multi-billion dollar enterprise or a small business with just a few staff members, adequate finances must be available to meet the costs of doing business. Whether a company is paying suppliers, employing staff, buying essential equipment, or paying for premises, having enough funding on hand is crucial for the successful start and maintaining daily operation.

When grants are not available, American Prudential Capital offers a full range of funding services to meet the unique needs of the American small business. Grants that are spent or simply unavailable along with other traditional funding methods pale in comparison with what entrepreneurs find with APC. The following are ways for women to find cash outside of grants to help start small and finish big. Of course, APC helps men too with these services:

Invoice Factoring

APC purchases a company’s invoices, paying you a percentage of the invoice value. This service is not reliant on a business’ credit rating, but rather on the rating of their customers, and gives you immediate cash flow so that business remains operational.

Purchase Order Financing

APC assists clients in finding PO Financing companies that settle supplier invoices so the company can fulfill large purchase orders from clients. This kind of financing is only available for retailers of third-party goods, or if the company purchases from a third-party manufacturing company. It is not suitable for manufacturing businesses.

Invoice Borrowing

Another method of getting loans is through accounts receivable, but small businesses keep their invoices and repay APC as they collect or when agreed upon. Many APC clients find that alternative loans accessing their invoices are better than adhering to the qualifications grants require. These funding methods are both creative and beneficial to all parties, so everybody wins.

Getting a new company off the ground presents enough challenges, so APC ensures everyone has a fair shot at success. Not only does a new company need to contend with all the pitfalls of being new–like getting the word out about the industry, what it can do for potential clients, and why this small business deserves a shot– but also all the pressures of simple, day-to-day operations. Startups have another option other than grants to start their business which can take a mountain of worry off the business. This option allows it to grow organically, becoming a part of the community and enriching the neighborhood with unique products and services that only a locally owned small business can bring.

Often a small business fills a niche, a specialty that could start if money had to come from a loan or federal program. APC is proud to back these adventurous spirits as they embark on the new entrepreneurship frontier. With the help of an experienced APC agent, these self-starters can get a firm hold in the Houston commercial market without having to depend on complicated loans and grants to get there. Not only does APC understand the difficulties of getting up and going, but they are committed to making America great again, one company at a time.

Learn More About Eligibility For Funding With American Prudential Capital

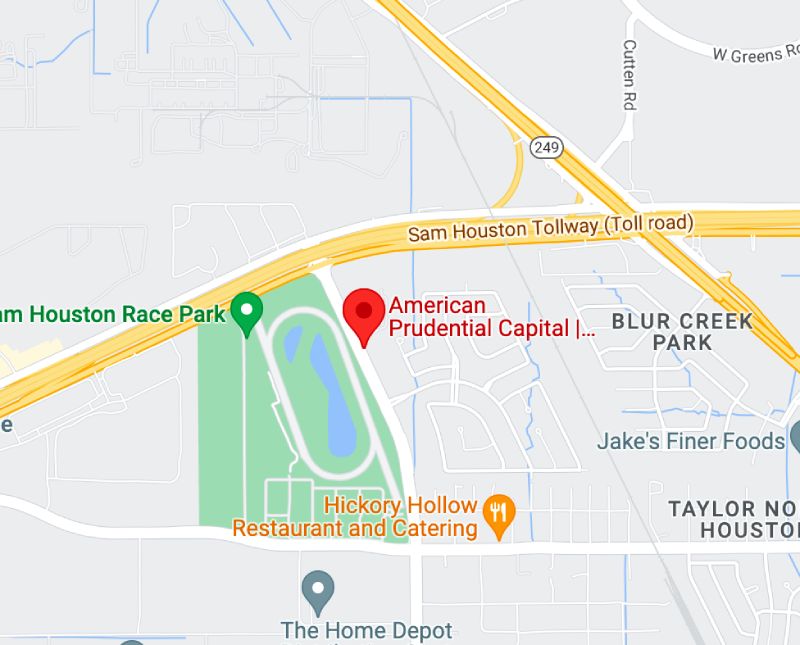

“He who hesitates is lost,” so take that first step today to discover innovative methods to start a new business in the Houston area. When traditional funding companies are reluctant to offer support, APC is there to lend a helping hand. Helping dreamers since 1989, American Prudential Capital consists of highly experienced advisors whose sole purpose is to help small business startups, without grants, get off the ground using innovative alternative funding options towards a fabulously strong start.

APC’s professionals are invaluable when it comes to finding unique methods of providing much-needed cash flow for the little guy. APC stands up for the underdog of commercialism and is proud to offer a leg up to the small business. By coming to APC, entrepreneurs know that their small startup business will find several attractive ways to get financing in place for their business to get a solid start in Houston.

Women business owners understand that sometimes a business needs a little creativity, especially when loans are not an option. They trust APC to help them find the perfect financial solution for their startup business. Startups can find support and peace of mind with APC services for small startup businesses.

Call APC now and speak to a well-qualified team member whose expertise and knowledge will help budding startup businesses understand how to get off the ground without the help of grants. An APC advisor happily discusses all avenues for startup funding. Unlike traditional funding institutions, APC does not rely on the business rating to make a decision, although some form of non-traditional collateral is required.

APC evaluates each application, based on its own merits, in coming to a decision. Once a company becomes part of the APC family, the seasoned professional advisors do everything possible to keep that family member afloat, helping meet the financial pressures of being a commercial enterprise in the Houston area.

Getting a strong start is critical to the success of a commercial industry, which is what APC gives a small business. Doing business is stressful enough without having to worry about how to keep the money flowing. APC is there to assist entrepreneurs in navigating the unfamiliar world of doing business. Do not let your small business fail before it even started. We have startup solutions for all kinds of small startup businesses, from distribution companies to IT service providers. We want you to succeed, and we want to be part of your success, so give us a call or get started now filling out the online application.

Small Business Startup Funding Other Resources:

- Official Minority Owned Fundable Business Launch Fund Government Opportunities

- Finance Investors Raise Though Crowdfunding Business Ways Platform

- Small Business Funding Opportunities for Funded Access to Start Financial

- Small Business Funding Investors Raise Crowdfunding Platform to Grow Funding Grants

- Official Business Funding for Funded by Investors World Grants

- Businesses Startups Federal Capital Start Loan Fund to Raise Business Finance

- Million Source Starting Minority Entrepreneur Business Including Government Ways