Why conceal from the truths? Working Capital from an Invoice Factoring Company is more expensive than a conventional credit line from a bank. Obviously, you may not receive bank funding or bank funding could be woefully short of your capital needs. Nevertheless, working capital is simply a business tool to be utilized and like all tools need to be utilized correctly. Let us look at the best ways to get the most out of your Invoice Factoring Company partner:

Use New Credit Department: Among the best tools with Invoice Factoring is you get a Credit Manager for free! A credit manager with credit data memberships can cost $75,000+ a year. A Great Factoring Company can remain on top of credit modification ratings of your existing clients, offer balance dues insurance coverage and pre-approve the credit quantity on potential new customers for you. So speak with your Aspect Account Representative frequently about these key business motorists to grow your business. A traditional bank will simply give you the money and not look weekly at your client’s credit value.

Have the Terms suit your Historical Cash Flows: A Good Element has advanced software to track your account. Lots of variables such as advance rates and charge triggers can be customized tailored just for your situation. For instance, your customers have a specific payment pattern. If they typically pay in 47 days you would not want an element who charges based upon a 15 day rate. On day 46 a new 15 day cost would be charged although your customer paid just 2 days thereafter. An Invoice factoring Company who cares about their clients will match your payment history to your fee table.

Earn money faster: Numerous business owners worry that Invoice Factoring will be seen as a negative to their customer. If your client has your finest welfare at heart, the exact opposite is true. Your Account Representative at a skilled Factoring Company will have a cordial but professional relationship with you and your client. Lot of times that the Element will verify that your billings remain in the accounts payable system of your consumer will all the proper paperwork will accelerate your capital. With an Invoice Factoring Company’s assistance you will be seen as more expert to you clients.

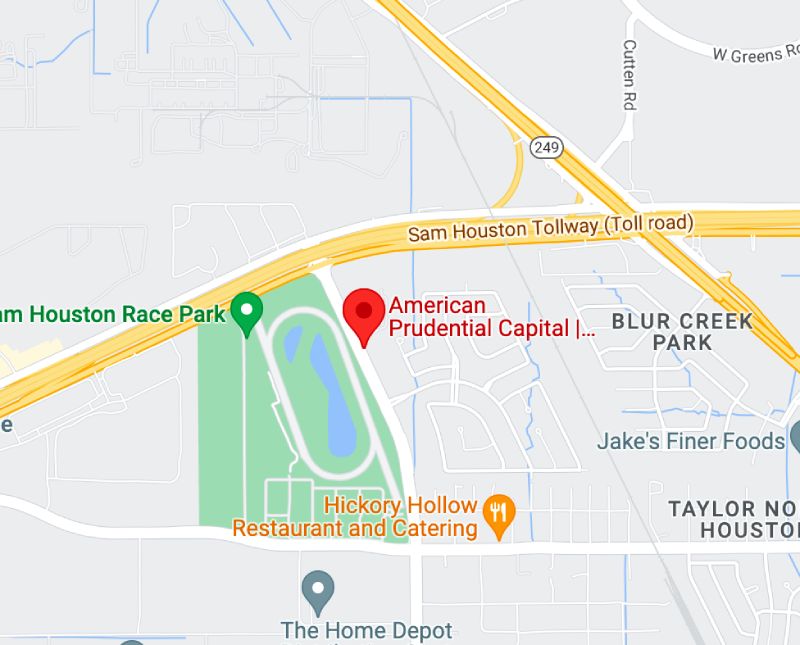

These are just a few of the methods to make sure your Invoice Factoring Company can fulfill your working capital requirements, offer you peace of mind and make your company more profitable. If you happened to be on Houston, American Prudential Capital is the Houston factoring company that you should look for.