Financing any service in the current credit environment is very difficult. Banks and numerous banks are retrenching their credit centers, requiring companies to look for financing somewhere else. Among the business sectors that has been hit the hardest is producing.

Production companies tend to be cash flow extensive companies. They are continuously paying providers and workers. There are equipment, payroll, supplier and leasing expenses to deal with. Most managers (or owners) will do their best to keep up to this day with these payments, or they run the risk of getting their business into difficulty. What usually gets cash flow into problem is that many customers pay their invoices in 30 to 60 days. Generally, the majority of owners need to pay suppliers before they earn money by customers. For that reason, unless the company has a cash reserve, it will face issues.

Production companies tend to be cash flow extensive companies. They are continuously paying providers and workers. There are equipment, payroll, supplier and leasing expenses to deal with. Most managers (or owners) will do their best to keep up to this day with these payments, or they run the risk of getting their business into difficulty. What usually gets cash flow into problem is that many customers pay their invoices in 30 to 60 days. Generally, the majority of owners need to pay suppliers before they earn money by customers. For that reason, unless the company has a cash reserve, it will face issues.

This situation can be repaired with business financing. Sadly, getting a company loan is the current environment is extremely difficult. Organisation loans are just not offered to companies unless they have outstanding credit and flawless financials.

But let’s examine the problem though. The problem is the timing distinction between when expenditures are made and when payment is received. If you speed up the payment, the issue is fixed.

How do you speed up a payment? One method to speed up a payment is to fund it through an invoice factoring company. When you factoring a billing, you designate it to a factoring business who offers you an advance payment for it. This sped up payment can be used to pay corporate expenses for that reason alleviating the pressure on your capital. The transaction is settled when your client pays the billing completely. Factors will charge a fee for their services, typically a portion of the invoice.

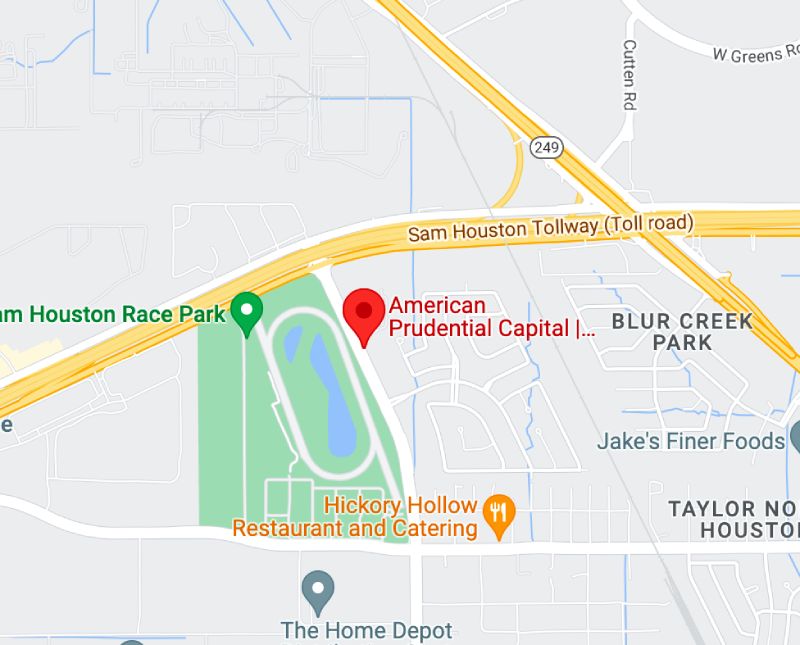

In an invoice factoring transaction, the factoring business is purchasing your billing, rather than lending your company loan. Since the factoring company is purchasing your billing, the business credit of your client (who really pays the billing) is crucial. Because of this, numerous business with excellent customers can qualify for factoring funding, even if they are startups or have some monetary problems. American Prudential Capital is one of the best Houston factoring companies.