Invoice factoring is rapidly ending up being a mainstream company financing tool that being used by little, medium and large sized businesses. It has been getting traction in part due to the fact that banks have tightened their lending standards, leading company managers to search for service funding in other places.

Although many business owners recognize with how company loans work, couple of are familiar with factoring. The most important thing to know about factoring is that it is designed to assist business that can not pay for to wait 30 to 60 days to get spent for their billings. Companies that sell items to other companies or the federal government typically need to wait 30 to 60 days to obtain their invoices paid. While some business have no problem extending 30 days terms, many do and cannot wait. Invoice factoring company fixes this problem by providing your company an advance for the invoice. This minimizes the amount of time you wait to get paid and provides funds to cover overhead.

When you factor an invoice, your company actually offers the monetary rights to the invoice to the factoring business. Because of this, the deal is structured as a sale, with two payments from the factoring business. The very first payment, generally referred to as the advance, is provided to your business as soon as you sell the invoice. The advance is about 80 to 90% of the invoice. You get the remaining payment of 10% to 20% (less factoring costs) when your customer actually pays the billing. This second payment is typically described as the rebate.

One major difference in between a business loan and a factoring line is that receiving factoring is a lot much easier and quicker. Because top factoring companies are normally purchasing the invoices they factor, their greatest concern is the creditworthiness of the business paying the invoices. Because of this, small businesses and distressed companies can normally have a great chance of getting a factoring line, offered they deal with a strong roster of clients.

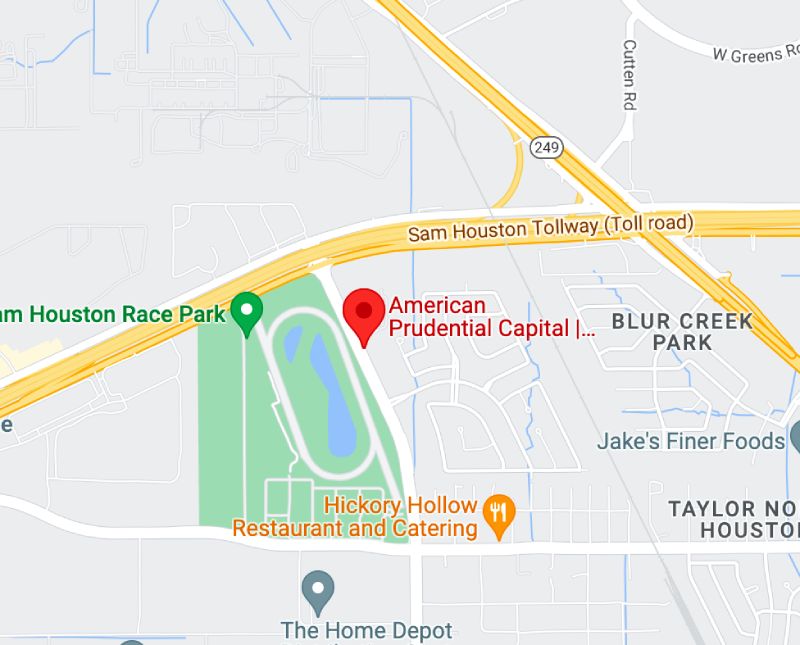

Expenses for factoring will vary but are usually higher than the cost of an organisation loan. Costs are determined by the size of the line, the credit quality of the billings, the industry and the stability of the client’s service. American Prudential Capital is one of the top factoring companies.