Managing the capital of a growing organisation is a continuous handle for company managers. On the income side, most of your clients wish to pay their invoices on 30 to 60 days. On the expense side, you have to handle numerous immediate expenses that have different payment timeframes. Most pressingly, payroll, which has the tendency to be either monthly, biweekly or weekly.

One method to improve your cash flow is to demand that your providers provide you the very same terms you offer your customers. In other words, if you provide 45 days of payment terms to your customers, you desire your suppliers to provide you 45 or more days. This is much easier said than done. Unless you own a big company or have flawless company credit, most of your providers will demand quick payment.

One of the simplest ways to get into a capital capture is to have clients that pay in 60 days however have expenses that are immediate. Your only option is to cover the space with your company’s resources until invoices get paid. Unless you beware handling your sales, revenues and expenses you are bound to get into trouble and run out of resources.

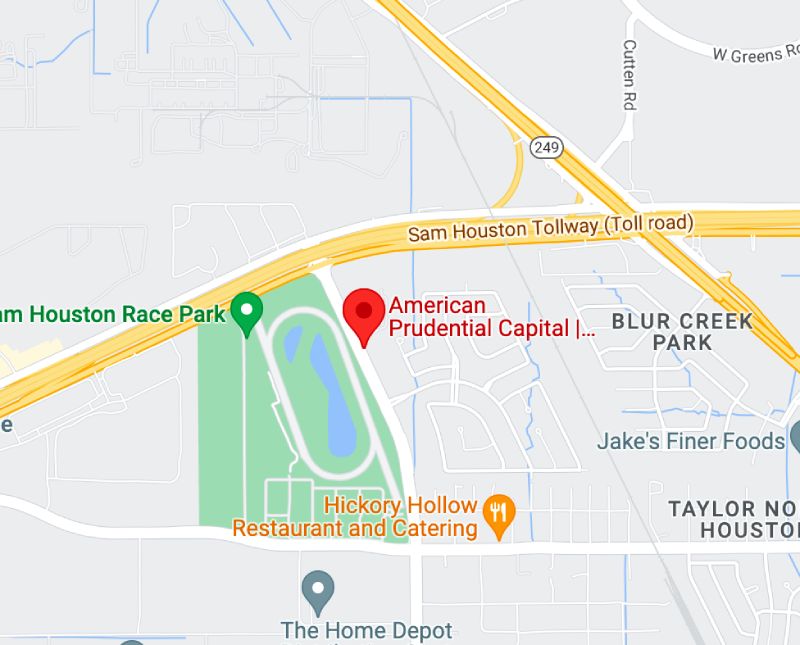

One way to resolve this issue is to utilize invoice factoring. Although a small business loan is viewed as an option by numerous, they have their own obstacles. They are hard to get, need extensive application processes and more notably, need that the business and its owners have remarkable credit. An option to a conventional service loan is to use invoice funding. American Prudential Capital is one of the best invoice funding company.

Invoice funding removes the 30 to 60 days invoice payment wait, assisting companies get a more steady financial footing. It’s offers the funds you have to satisfy you instant expenditures, enabling you to tackle brand-new opportunities.

One vital distinction in between invoice funding and other products is that invoice funding companies take a look at the credit value of the business paying the invoice as their crucial source of collateral. This function makes invoice funding a viable option to little companies with thin or no credit, but a strong list of customers.

The majority of invoice funding transactions are arranged as a billing purchases, where the invoice funding company finances/purchases the billing in 2 installations. The first payment, typically 80% of the invoice, is made as quickly as you send the invoice to your customer. The staying 20%, less the discount rate, is advanced as quickly as your client really pays for the billing.