Invoice factoring helps factoring business to keep track of their capital. With arrival of high speed Internet & inexpensive Computer systems have created the ideal environment for Online Invoice Factoring. Best factoring company can provide faster service & process billings sometimes within 24 Hr. With the popularity of the internet & online invoice factoring, more services are taking advantage of factoring. Invoice factoring & balance dues have become a cost effective method for organisations to grow & become more flourishing. Prior to Online Invoice Factoring, Unless you had the advantage to have actually gone to company school, you probably didn’t know what invoice factoring was. It has now become a popular way of doing business for startup business, normally under 3 years or a fully grown business in a development spurt.

The invoice factoring procedure can be done again every time you invoice, providing you with a flexible line of funding that grows with your business. As you can see, billing factoring is a relatively uncomplicated tool that enables business owners to take advantage of their most precious possession – their invoices. Invoice factoring, likewise referred to as receivables factoring, is a financial tool that enables small business owners to take advantage of the powe of their sluggish paying billings. Invoice Factoring is a plan whereby a financial institution will advance loan versus the value of the business sales ledger receivable balance or future sales invoices as they are raised.

If sales ledger financial obligation presently exists then a considerable money lump sum could be offered through factoring the receivable balance. In easy terms, here’s how invoice factoring works: Factoring companies acquire your receivables or freight bills at a discounted rate and issue you a lump sum payment. We can provide you with a factoring, invoice factoring or receivables factoring quote totally free.

Since ready cash is so important in their business, markets that are greatly vested in human services and have to have the ability to fulfill payroll are amongst the very best able to take advantage of invoice factoring. Compared with loans and lines of credit, which require the customers to have concrete properties and strong financial, invoice factoring helps one to achieve money quickly.

Generally, factoring business pay 80 percent of the billing worth upfront. If your business offers service or products to big credit worthwhile business, you might certify for invoice factoring funding. Although lots of entrepreneur will go to a factoring company to obtain financing, factoring companies also supply other crucial services Invoice Factoring often enables greater access to financing for business where financing can typically be more difficult to gain access to because of the age of your organisation or the lack of security you can offer.

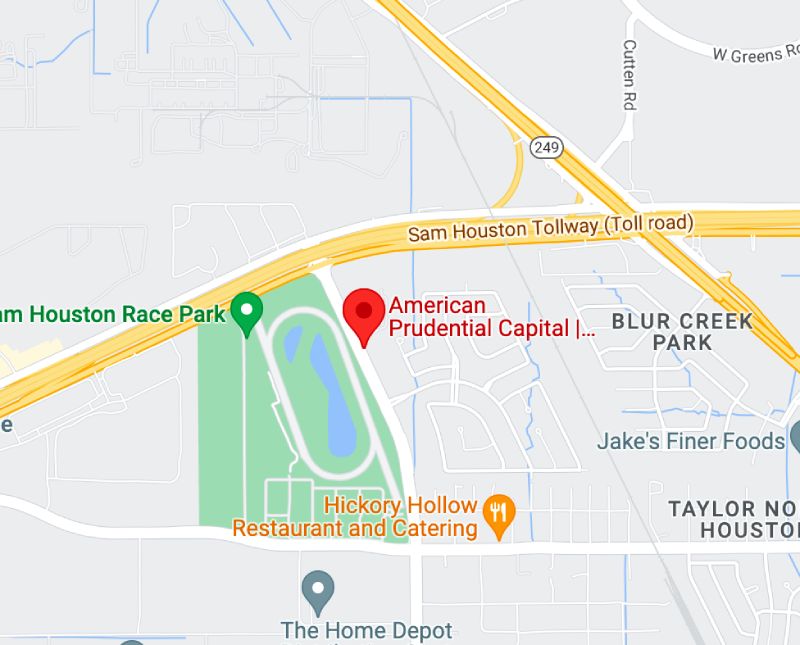

Invoice factoring can offer the working capital your company needs to manage brand-new tasks, fill large orders and pay financial institutions on time or perhaps early. Invoice factoring business are useful to services in that they provide the working capital needed when the clients cannot pay on time. Invoice discounting, like invoice factoring ensures the working capital required in times of requirement, and acts as a perfect financial obligation management option for a service. American Prudential Capital is the one you should look for.

A crucial advantage of Invoice Factoring is its ability to supply credit management developing important time for your business. As you can see, invoice factoring is a reasonable alternative to other funding products, provided that you can fulfill particular criteria. While choosing an invoice factoring professional ensure that they do not bother your consumers.

Invoice factoring rates differ commonly from loan provider to lender, with commissions and incentives to tempt consumers. Because of these advantages, factoring business can be fantastic service partners and help finance your business development. As you can see, the sale of your invoices provides you with accelerated funds that can be used to run and grow the company.