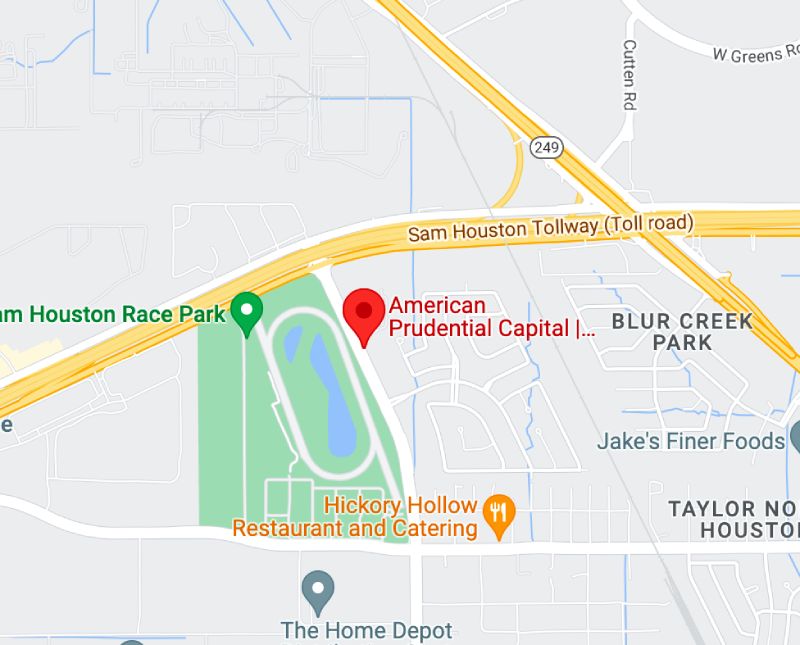

Are you trying to find funding in Houston? Read this short article to learn how Houston Factoring Companies (likewise known as invoice discounting) works. American Prudential Capital is one of them.

Among the more common service problems involves dealing with sluggish paying clients. In a lot of organisation to company deals, a product or service is offered to a customer who pays in 30 to 45 days. Providing this type trade credit is generally the norm, particularly if you are selling to large business. Generally, larger companies get better use of their cash by making their suppliers wait to get paid. It’s that basic.

This contract works well if the supplier, in this case yourself, has the ability to wait 45 days to get paid. Some can. Many can’t self financing, due to the fact that they have responsibilities they have to fulfill. There is payroll. There are providers. There is lease and lots of other expenditures that should be met.

This issue can be resolved quickly with Business financing. Nevertheless, everybody understands that Business credit is tight and very tough to get. Many organizations are making conservative decisions. They need to see properties, solid financial statements and an excellent track record of running you organisation. This put organisation loans from the reach of a lot of company owner. However a service loan is not the only way to fix this particular issue, nor is it constantly the best solution.

A better solution might be to factor your billings. Invoice factoring is a kind of transaction where an invoice factoring company provides you an advance for your 30 to 60 day billings. This provides you with the funds to fulfill payroll and other important expenses. The deal is then settled once your customer really spends for the billing.

One of the benefits of factoring is that it’s easy to get, when compared to other products. Factoring business protect their position by holding the billing as security and they consider this your crucial security. This an important function because it supplies financing to business whose biggest – or only – possession is a solid client base. One additional benefit of invoice factoring is that the credit limit is vibrant and tied to your invoices. If you increase your billings to reliable clients your factoring line will generally be increased to match it.

Although billing factoring is definitely not a treatment all computer technology articles, it works very well in instances where the significant business obstacle is the failure to wait to get paid by customers.