At some point or another, each business will require financing to develop. Most proprietors will attempt to meet all requirements for funding or blessed messenger financing. Others will attempt to get a business advance or credit extension, since business advances are prominent with entrepreneurs.

All these business financing tools works admirably, however they additionally have a critical attribute in like manner. They are difficult to get and distant for generally proprietors.

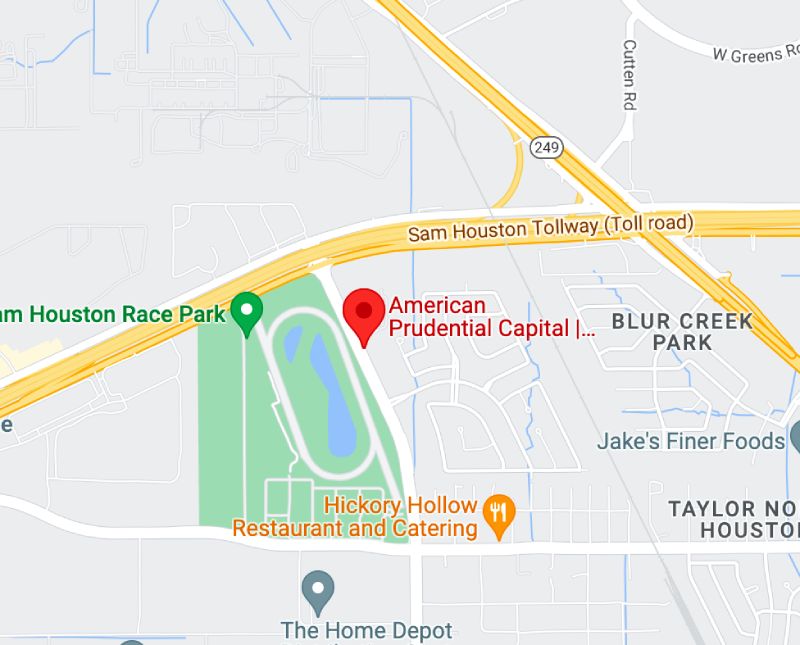

There is an option method for financing your business development. Financing that is anything but difficult to meet all requirements for, speedy to set up and exceptionally financially savvy. Not just that, it’s financing that develops with your business. What’s more, more often than not, you won’t get it from your nearby bank. This type of financing is called invoice factoring and you can get it from an invoice factoring company and American Prudential Capital is one of the best.

Factoring is not quite the same as a bank advance and it functions admirably if your most serious issue is that you can hardly wait the 30 to 60 days that business customers take to pay their invoices. Essentially, invoice factoring slices the installment time to two days.

Factoring is basic. best factoring companies purchases your invoices (at a little markdown) and pays you for them quickly. At that point, the factoring company holds up to get paid by your customer. The net outcome: you get prompt working money to pay costs of doing business and develop. You additionally wipe out the worry of waiting to get paid and can rely on an anticipated income.

As a type of financing, factoring offers two exceptionally particular points of interest over bank advances. In the first place, it’s anything but difficult to fit the bill for. Your primary necessity is that you work with solid business customers (or the legislature). Second, factoring financing develops with your business. As your invoicing develops, so does your financing. This empowers you to effortlessly take care of the expanding expenses of maintaining a business that is developing.

A comparative kind of financing that is likewise offered by factoring organizations is buy arrange financing. Buy arrange financing furnishes you with financing in light of your buy orders from huge business customers. Buy arrange financing is perfect for re-venders and merchants that are developing rapidly.

Regardless of whether you require financing in light of the fact that your clients pay you in 60 days or on the grounds that you have a vast buy arrange from your greatest client Business Management Articles, a factoring company will have the capacity to offer contrasting options to customary financing.